Most people look forward to becoming eligible for Medicare, but “aging in” to the program can be intimidating. There’s a lot to learn! We hit the streets to find out what some Medicare-age folks really think of the whole process.

Most people look forward to becoming eligible for Medicare, but “aging in” to the program can be intimidating. There’s a lot to learn! We hit the streets to find out what some Medicare-age folks really think of the whole process.

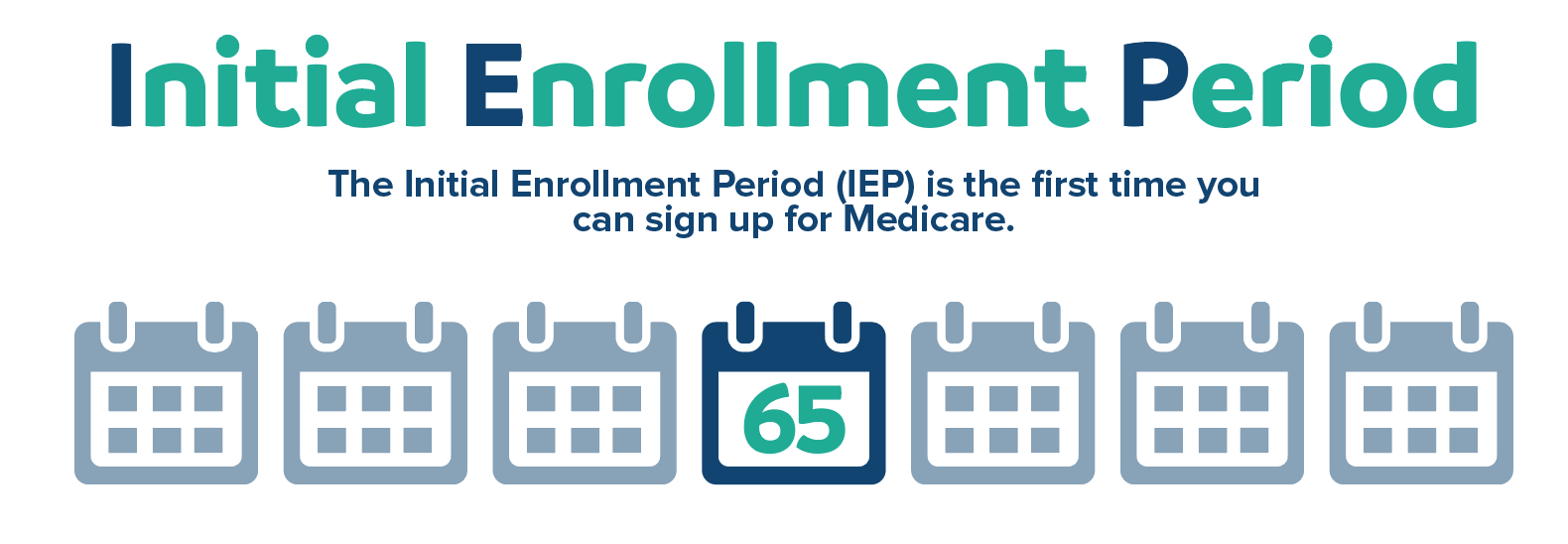

Rebecca knows the basics, “I know that when I turned 65, I was able to partake of Medicare that I had paid into for years.”

And Linda found the process a bit confusing, “It should be a lot more simple,” she says. “I’m just saying it would be easier for all of us.”

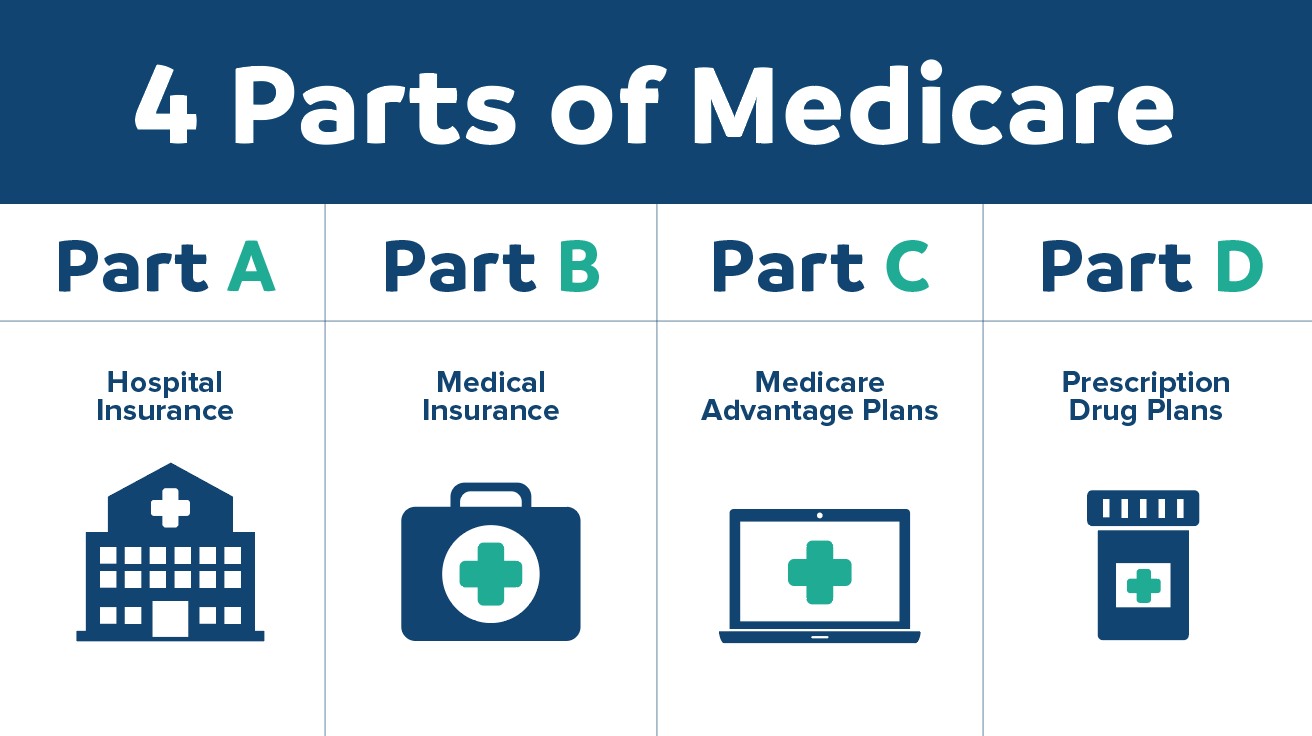

Deborah is a healthcare provider and she admits it could be more clear, “I think right now, in terms of my contemporaries, my peers, that will be going on Medicare, they don’t necessarily understand it.”

Definitely do your research, because you generally only have seven months to sign up for Medicare the first time. Your Initial Enrollment Period, or IEP, begins three months prior to the month of your 65th birthday, includes the month of your birthday, and ends three months after your birthday month.

Your Safety is our Priority! Masks May Be Required at Millennium Offices.

Your Safety is our Priority! Masks May Be Required at Millennium Offices.